It would be difficult right now to find any business who, at some point, has not tried to sell something directly on Ebay or Amazon – or have even set up their own E Commerce website to sell products. Given more than 83% of uk businesses now have a website (Statistica 2020) you can safely say that 4 out of 5 businesses have at least dabbled in online marketing and if they sell products have tried to sell these products online.

With the events of recent months with COVID 19, the desire for businesses to use distance selling to reach new markets will only increase exponentially. The E-Channel project is currently looking for 12 businesses to work with to help define an effective model for new market entry online and has developed an initial data prototype to help test the model. The model is based on several year’s experience of online selling at Vertical Plus (UK) and at Soledis (FRANCE) .

The model incorporates four important stages of E Commerce new market entry and growth. These stages are not completed in any particular order – they are simply put together when any new market plan is put in place and then they are monitored during and at the end of new market entry.

Before I move onto to describe these stages in more detail I want to talk a bit more about new markets. By new markets I mean this in the most traditional marketing way possible. In its simplest form, a new market is a distinguishable group of potential customers that might buy your products. This then begs the question: why are they potential customers and what makes them different? In marketing terms this is called market segmentation.

In my experience at Vertical Plus the average small business struggles to grasp even the most basic aspects of customer segmentation. There is a tendency to rush products online and a “live by the sword, die by the sword” mentality. So many small businesses will throw products on Ebay and if they work great and if they don’t tough.

Even if a business did try to plan then at the start there is very little to work on. For example, if a business selling garden furniture wants to explore new markets using a market segmentation matrix they would need to see data on uk sales of product ranges to understand what is selling and what isn’t. They would need to see who it is being sold to and also understand seasonal variations before then segmenting the market and deciding what customers to target. Existing market players will have this data and they would be extremely unlikely to share it with potential competitors. So even from the start the data upon which to base new market strategy will be missing leaving businesses to rely upon guesswork, intuition and hope!

A good market entry strategy is one that is planned as much as possible but is also extremely reactive to market data. Businesses only need a small amount of time in the right places to start to see where demand is and where the new potential customer opportunities are. Online market places provide a wealth of data which can be used to identify opportunities and trends. These test marketing opportunities provide early opportunities to grow understanding of new markets.

Assumptions

The model is based on the following assumptions:

The Model

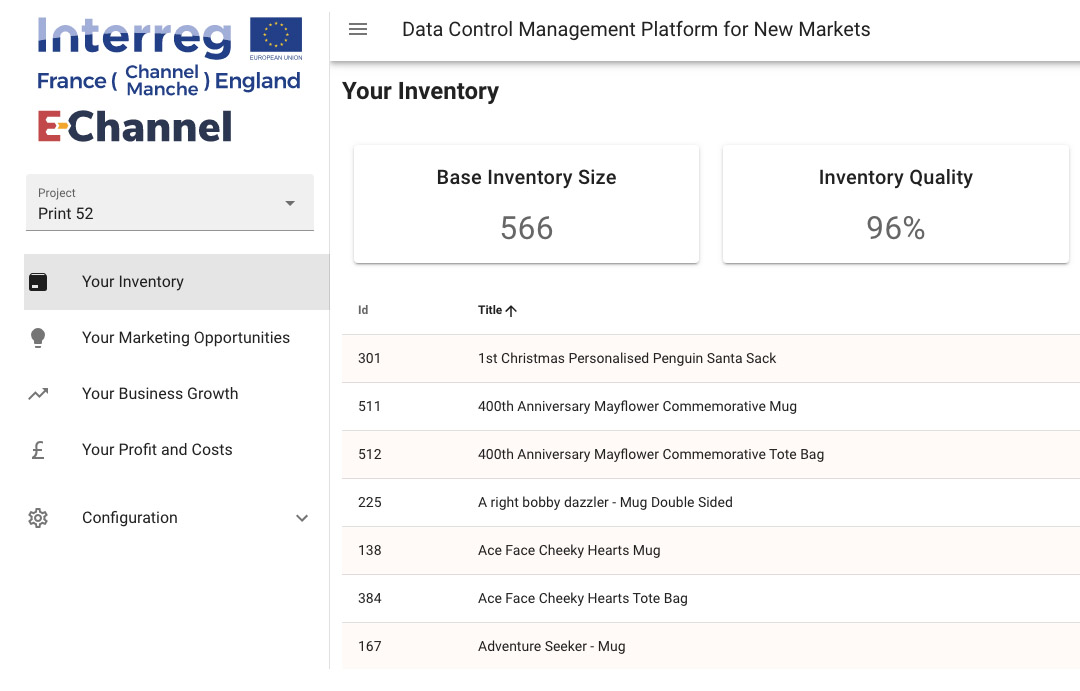

The model itself tracks four things: Inventory, Opportunity, Profit and Growth. In the most simplest form the model works like this:

If you get your costs, profit and inventory well tuned to a new market place from the start then that market will show interest in your products. Having shown interest, this creates opportunities for you to act upon in that marketplace. The initial interest or sales can be acted upon and this creates trackable market growth. This process can happen again and again if opportunities are regularly reviewed and acted upon. However opportunities are only viable if they are products which can sell at a profit so it is also important to understand the true costs and profit. The model is one which focuses therefore on inventory, profit and costs, opportunity and sales growth.

Inventory. It is essential first and foremost that the business organises its inventory for the new market place. Some of this is basic (for example organising translations for sales in France) some of this is complex (for example understanding and tracking keywords and category placement specific t each online marketplace). But work needs to be done on inventory in the first place to make sure that the effort is going to be worth it. Moving on into the future regular inventory reviews based on opportunities being presented are also important.

Opportunity. In our experience new market entry for most businesses will only be partially successful. Even with the best will in the world less than 5% of product ranges will sell even once. But there are always opportunities. The key to successful growth in a new market is to learn how to identify and act upon these opportunities. In this way online businesses always evolve to follow product or customer opportunities that present themselves on the way. Once sufficient data has been gathered the more a business strategises these opportunities and the more likely it is that market entry will be successful.

Cost. There are a wide variety of costs (both direct and indirect) to new market entry. A common mistake many businesses make when they enter a new market is that they fail to understand the true cost of sales. Even if the cost of delivery or the cost of marketing and commission payments are calculated correctly, there is then also the cost of returns, refunds, storage and even warehouse staff and rent and rates. Therefore we have built into the model the concept of yield on investment. This puts together the total investment made in trying out new product lines in the new market with the true yield of the investment. In this way businesses are making choices not so much on what is selling but what is more profitable.

Business Growth. The final factor in new market entry is business growth. This is important to online businesses as to a large extent most new market entries will not be profitable right away. It can take several months for the impact to take hold and in the early days of new market entry marketing costs will be higher compared to the volume of sales and profit. So it is important to measure several key factors about business growth to develop the right strategy. The model includes these key factors.

The model is expected to be released through E Channel on the 1st June. As mentioned earlier we have funding to work with 12 businesses who we feel will benefit substantially from the model and also from our participation in working with them in new market entry. If you would like to be involved please contact us on info@e-channel.org.

If you would like to grow your business into markets across the Channel then please get in touch